Dear Reader,

Hello again!

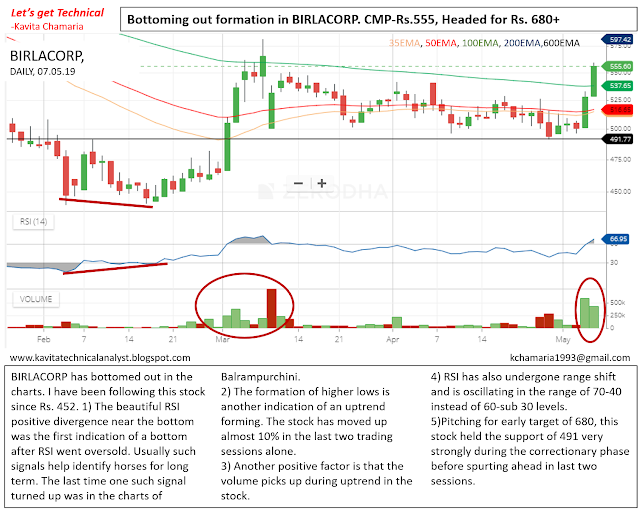

The daily chart of Mothersumi is showing the beginning of a new uptrend on the daily chart. Signs of accumulation are evident. The image below highlights the same.

This is a very basic set-up often observed at the beginning of a strong uptrend. The big cats are buying the stock and hence the swell in volumes.

Mothersumi was an all time favourite of investors until the dawn of Electric vehicles brought its twilight. The stock has corrected almost 60% over the past 18 months from the high of Rs. 260.

Currently, the first resistance lies at level Rs.128. A sustained closing above this level would mean a confirmation of the uptrend trend. Accumulating the stock at this level is an opportunity rarely spotted!

Another positive is my favourite RSI positive divergence at the bottom. It is evident in the above chat (not highlighted) that when the price marked the low of Rs. 113, the RSI did not forge a corresponding low but took a support at the level of 30 indication a positive underlying momentum.

This combination of positive divergence in RSI and accumulation in volume is a pretty sure shot way of identifying stocks in the early stage of an uptrend.

Mothersumi is a great company with a top class management team. Following this article I will continue to share the news updates and subtle changes which reinforce/oppose this bullish view.

Please follow my page on Facebook here for news updates on the stocks I write about in my blog.

Stay tuned for more updates on potential rally stocks.

Choose the platform you use the most and follow the link to follow Let's get Technical on the go!

Hello again!

The daily chart of Mothersumi is showing the beginning of a new uptrend on the daily chart. Signs of accumulation are evident. The image below highlights the same.

|

| Mothersumi on 13.06.19 showing accumulation signs |

Mothersumi was an all time favourite of investors until the dawn of Electric vehicles brought its twilight. The stock has corrected almost 60% over the past 18 months from the high of Rs. 260.

Currently, the first resistance lies at level Rs.128. A sustained closing above this level would mean a confirmation of the uptrend trend. Accumulating the stock at this level is an opportunity rarely spotted!

Another positive is my favourite RSI positive divergence at the bottom. It is evident in the above chat (not highlighted) that when the price marked the low of Rs. 113, the RSI did not forge a corresponding low but took a support at the level of 30 indication a positive underlying momentum.

This combination of positive divergence in RSI and accumulation in volume is a pretty sure shot way of identifying stocks in the early stage of an uptrend.

Mothersumi is a great company with a top class management team. Following this article I will continue to share the news updates and subtle changes which reinforce/oppose this bullish view.

Please follow my page on Facebook here for news updates on the stocks I write about in my blog.

Stay tuned for more updates on potential rally stocks.

Choose the platform you use the most and follow the link to follow Let's get Technical on the go!

Blog: https://goo.gl/qd2jDG

Twitter: http://bit.ly/2QLoQm6

Facebook: http://bit.ly/2RQErlN

LinkedIn: https://bit.ly/2QR4ZBY

Instagram: https://goo.gl/ftYub6

Also, join my FB group! https://www.facebook.com/groups/250550478994070/