Hello Readers!

STOCK NAME: SNOWMAN LOGISTICS

TICKER NAME: SNOWMAN

CMP- RS. 61.25

TARGET - RS. 85, 118

STOPLOSS- RS. 55

Snowman Logistics grabbed eyeballs in 2015 at the time of its IPO. The price band was Rs. 44-47 and the stock listed at Rs. 75. Back then, the market was not as interesting and volatile as it is today and this return meant serious and rare money for investors.

Today the stock is trading lower than its listing price. Over the past 5 years, the stock has been correcting gradually, however, that does not undermine the importance of logistics in a country like India.

A look at the monthly chart shows strong movements. The two signs of strength are:

1) Volume is higher- Indicating accumulation which is supportive for a strong upside

2) The RSI has moved into the overbought zone, which is above 60, indicating strong bullish momentum.

3) Most importantly, the price has forged a higher-high on the chart (breakout) and is continuing to move in the upward direction

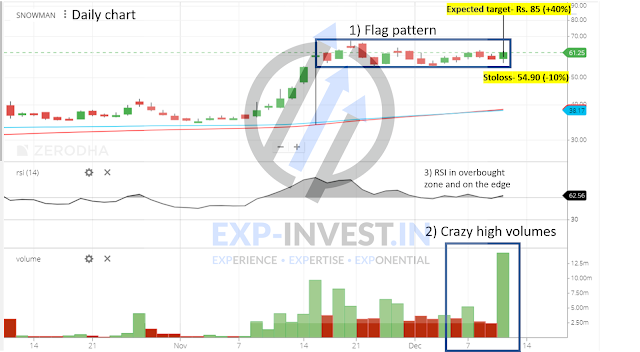

Let's look at the daily chart and determine if there is similar positivity:

1) There is a flag pattern on the daily chart with exponentially high volume as highlighted below in daily chart

2) RSI is continuously in the overbought zone which is a sign of momentum refusing to give up on Snowman

3) The volume observed on 10th Dec. 2020 was very high even though the price did not budge noticably. I am expecting a strong upside move from here onwards.

It is not every day that we come across such neat textbook patterns. These are easy to spot, read, and execute.

I hope this analysis helps you make sound investment decisions and learn while you do it. Please feel free to write to me for more explanation at kchamaria1993@gmail.com. You can also join my whatsapp group by following this link.

To conclude, in the near term, I am anticipating a target of Rs. 85 and long term- target of Rs. 118 with a stoploss of Rs. 55 from the current market price of Rs. 61.25.

Happy Investing!

Thank you for reading, please leave your comments below if you enjoyed it!

Choose the platform you use the most and follow the link to follow Let's get Technical on the go!

Blog: https://goo.gl/qd2jDG

Twitter: http://bit.ly/2QLoQm6

Facebook: http://bit.ly/2RQErlN

LinkedIn: https://bit.ly/2QR4ZBY

Instagram: https://goo.gl/ftYub6

Regards,

Kavita Chamaria